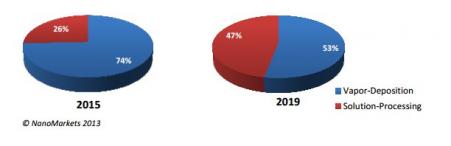

Nanomarkets: solution-processed OLED materials to take up 47% of the OLED market by 2019

Nanomarkets released a new white paper about solution-Processed OLEDs. They estimate that in order for the OLED market to grow significantly for TV and lighting applications, companies must adopt solution-processable materials. Soluble OLEDs have been researched for years with very little outcome outside of the lab. But Nanomarkets believes that the current problems can be fixed, and are worth fixing.

Soluble OLED materials and appropriate processes are being researched by Sumitomo, DuPont, Pioneer, UDC, Solvay, Marck and others. They estimate that the first panels to be made using these materials will be Pioneer's (together with Mitsubishi) OLED lighting panels - planned for 2014. Nanomarkets thinks that if Pioneer succeeded, it may push GE back into the OLED game with their own soluble material solutions. It's interesting that Nanomarkets does not mention Panasonic's OLED TV prototype that uses Sumitomo's P-OLED materials.