China-based Visionox was founded by Tsinghua University and other investors in 2001 with an aim to develop and manufacture OLED display and lighting panels.

China-based Visionox was founded by Tsinghua University and other investors in 2001 with an aim to develop and manufacture OLED display and lighting panels.

Visionox produces AMOLED displays, since 2015, and the company has four productions line:

- Gen-5.5 rigid line in Kunshan (V1)

- Gen-6 flexible line in Hefei (V2)

- Gen-6 flexible line in Hebei (V3)

- Gen-6 flexible line in Guangzhou (V4)

In 2024 Visionox announced it will invest $7.6 billion USD to build a 8.6-Gen production line in Hefei, targeting IT AMOLED applications.

In 2015 Visionox spun-off its OLED lighting business into a separate company called Yeolight Technology. In 2021 Visionox spun-off its PMOLED business to Qingyue.

Visionox produces a wide range of AMOLED displays. The company is also actively developing microLED technologies via its Vistar subsidiary.

Huanyang Plaza, 1 st East Road

Shangdi

Beijing

100085

China

Omdia: shipments of OLEDs over 9-inch in size will soar 124% in 2024

According to Omdia, sales of OLED panels in sizes over 9-inch (the company refers to these as Large Area Displays) will increase 124.6% in 2024. In 2023, the market contracted 25.7%, with the only exception being OLED monitor panels that grew in shipments.

In 2024, Omdia says that all application areas will see an increase in shipments - TVs, monitors, tablets and laptops. Only the company's "other" category will see a decrease in sales. In particular, tablet OLED shipments are projected to increase by 294% compared to 2023, largely due to Apple's adoption of OLEDs in the 2024 iPad Pro tablets. Laptop OLED sales will increase 152.6%, and monitors OLEDs will increase 139.9%. Finally, OLED TV panel shipments will increase 34.8%.

DSCC sees 9.25 million foldable OLED panels shipped in Q2 2024, with Samsung returning to a dominant position

DSCC says that foldable OLED shipments increased 46% in the first quarter of 2024 compared to last year, to reach almost 4 million units.

BOE was leading the market in Q1 2024, with a market share of 48% (up from 43% in Q1 2023). The two leading foldable smartphone models were Huawei's Mate X5 and Pocket 2, using panels supplied by BOE. In fact Huawei had a market share of 55% in the foldable smartphone market.

Omdia estimates that China's foldable OLED panel production will surpass Korea's in H1 2024

Omdia says that China's OLED makers have been making rapid progress with their foldable OLED capabilities, to the point that in the first half of 2024, China's production of foldable OLED panels will surpass Korea's.

Omdia predicts that in the first half of 2024, Samsung Display will produce 5.7 million panels, while China's producers will produce 6.4 million panels. The market is set to grow quickly, from 10.7 million units in 2021 to 30 million panels in 2024. The market leader remains Samsung (47% in 2024H1), followed by BOE (40%), Visionox (9%) and TCL CSoT (4%).

Visionox announces plans to build a $7.6 billion 8.6-Gen AMOLED line in Hefei

Visionox is the latest company to announce a new AMOLED production line, targeting the IT display market - laptops, monitors and tablets. The company said that it will best 55 billion Yuan (around $7.6 billion USD) to build a 8.6-Gen production line in Hefei, Anhui province.

Visionox's production line will have a monthly capacity of 32,000 substrates. The company did not share any details regarding the timeline of this project, or its financing.

Visionox shows its latest OLED and MicroLEDs at Displayweek 2024

During Displayweek 2024, Visionox demonstrated many OLED display technologies and panels, and also an interesting microLED prototypes (produced by its subsidiarity Vistar).

Visionox is in the final stages of development of its ViP maskless display production process, and the company showcased some nice ViP smartphone panel prototypes (the technology can be used for any panel size). ViP offers a high improvement in aperture ratio (69% up from 29%) which results in low power consumption and brightness (up to 4X according to Visionox), improved lifetime (up to 6X), improved PPI and more.

China's small-to-medium OLED production surpasses Korea's for the first time

According to Sino Research, in the first quarter of 2024, small-to-medium AMOLED production in China surpassed the production in Korea, by shipments, for the first time. China's market share was 53.9%, an increase from 44.9% in Q4 2023.

The leading producer is still Samsung Display, with a 41% market share (down from 53.3% last year). BOE has a market share of 17%, Visionox 12%, CSoT 10%, Tianma 9% and LGD 6%. The mean reason for the rise in China production and a decline in Korea's is lower shipments to Apple and an increase in the adoption of OLEDs in Chinese smartphones.

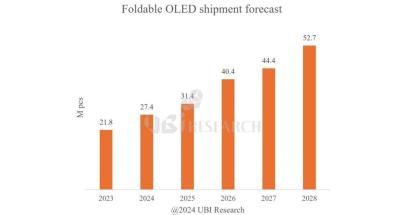

UBI: the foldable OLED market will grow to 52.7 million units in 2028, Samsung Display to remain the market leader

UBI Research released its latest foldable OLED shipments forecast, saying that it expects the market to grow from 27.4 million units in 2024 to 52.7 million 2028.

The market is dominated by Samsung Display, which shipped 13.4 million foldable OLEDs in 2023, and holds a 61% market. Samsung is followed by BOE (6.2 million, growing 3X from 2022), TCL CSOT (1.1 million) and Visionox (1.1 million). UBI expects Samsung Display to remain the clear leader in this market as it is the sole supplier to Samsung Electronics - and it is also expected that Samsung will be the exclusive supplier to Apple's future foldable iPhones.

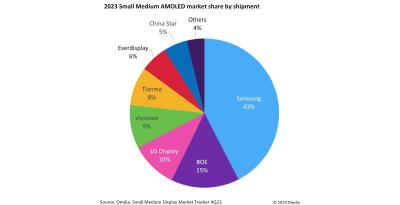

Omdia: Samsung leads the small and medium AMOLED market with a 43% market share in 2023

Omdia released its small and medium (9-inch and lower) AMOLED market share information for 2023, saying that even though Samsung's market share was lower than 50% for the first time, it stills leads the market by a large margin, with a 43% market share.

Samsung is followed by BOE (15%), LG Display (10%), Visionox (9%) and Tianma (8%). The total market reached 842 million units, a growth of 11% over 2022. Omdia says that the China-based OLED makers have been expanding their capacity and improving the quality of the produced panels, and are securing orders from domestic smartphone brands.

Visionox produced its first ViP AMOLED display, is progressing towards mass production

Visionox announced that it has produced the first mass-production sample ViP AMOLED display. The company aims to start mass producing small and medium-sized ViP AMOLED soon, and later apply the technology for large-area panels as well.

The company did not detail when it expects to start actual mass production. It did update that it has already applied for over 500 patents regarding to ViP technology, over 13 different technical fields. The company also says it is in talks with several key customers to define its production process and final display capabilities.

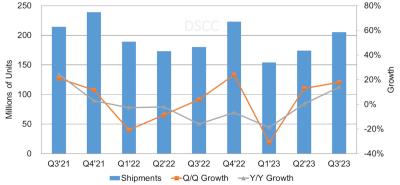

DSCC: OLED panel shipments increased in Q3, with strong shipments from Visionox, LGD and CSoT

DSCC reports that according to its information, OLED panel shipments in Q3 2023 increased 14% from last year (and 18% from the previous quarter) to reach 205 million units. There are positive signs that inventory has started to rebalance for some categories.

OLED smartphone shipments increased 12% over last quarter (and 25% from last year), while OLED TV shipments continue to be soft, and dropped 14% from last quarter and 40% (!) from last year.

Pagination

- Page 1

- Next page