What are wearables?

Wearable computers, also called ‘wearables’, are technological devices that can be worn as clothing or accessories. Some wearables are based on relatively simple technology, similar to a scaled-down desktop computer, but some involve innovative technologies. Wearables include different products, such as fitness bands, wearable headsets, smart watches, healthcare monitoring and displays embedded in textiles.

The wearables market is diverse, but faces similar challenges like minimizing size and weight of components, deciding on optimal display location, choosing suitable services and applications to provide and balancing cost-to-price ratios. Most devices commercial today are either fitness bands or smartwaches, and VR/AR HMDs.

What is an OLED?

OLED is a light-emitting diode built from thin films of organic electroluminescent material sandwiched between electrodes. OLED devices emit light when current is run through them, and are used to develop display and lighting panels. OLED screens are thinner, lighter, more efficient and offer better performance and color quality than other existing technologies.

OLEDs divide into 2 groups: AMOLEDs and PMOLEDs, which refers to how the screen is addressed by the electronics of the device. Simple wearables such as fitness bands sometimes adopt PMOLED displays, while smartwatches and VR headsets opt for AMOLEDs. Here's more information about AMOLED vs. PMOLED technologies.

The OLED wearables market

OLED displays are very popular in the wearables market - thanks to the great image quality, the low power consumption and to the design possibilities enabled by flexible OLEDs. Today OLED is the dominant wearable display technology, and most high-end smartwatches, fitness bands adopt OLED displays, including both Apple's and Samsung's smartwatch ranges. Here's our comprehensive list of wearable devices that use OLED displays.

Samsung announces the Z Flip6 and Z Fold6 foldable smartphones, and two new OLED wearables

Samsung announced today four new devices - two foldable smartphones, and two smartwatches, all with AMOLED displays. All of these devices will ship on July 24.

First we have the latest clamshell smartphone, the Galaxy Z Flip6 - that has a foldable 6.7" 120Hz 2,600 nits 1080x2640 LTPO AMOLED display. It also has a 3.4" 720x748 Super AMOLED cover display.

Omdia: adoption of OLEDs in smartwatch applications grows to 37% of the market

Omdia says that it expects the global smartwatch display market to reach 359 million units in 2024 (up from 259 million units in 2022). OLEDs hold a 37% market share (132 million units).

Omdia says that the leading smartwatch OLED producers, in the first half of 2024, are LG Display (Apple's main supplier), Everdisplay and Tianma - which together hold a 53% market share. China-based wearable OLED production accounts to 64% of the total market.

Tianma shows its latest OLEDs and MicroLEDs at Displayweek 2024

China-based Tianma had an impressive booth at Displayweek 2024, showing numerous OLED and microLED displays and prototypes.

For the automotive market, Tianma showed three new display prototypes. First up is a 13" slidable OLED, with an embedded touch panel, aimed towards car dashboards or center controls.

Japan Display to start producing eLeap laptop displays at its 6-Gen Mobara fab, ahead of schedule

In 2022, Japan Display (JDI) announced that it has developed a "historic breakthrough in display technology" - a new OLED deposition process which they refer to as eLEAP, that is said to be cost effective and can be used to create freeform OLEDs that are brighter, more efficient, and longer lasting compared to OLEDs produced using mask evaporation (FMM).

JDI is planning to establish a 8.7-Gen eLEAP fab in China, and it is also building a smaller-scale 6-Gen eLEAP production line in Mobara, Japan. The company announced that the 6-Gen Mobara fab is advancing ahead of schedule, and production of eLEAP panels will begin before the end of 2024. JDI developed 14" laptop panels that are three times brighter than other OLEDs (at 1,600 nits), and is also targeting smartwatches, smartphones and automotive displays. JDI is also looking into adopting a tandem structure, to increase brightness even further to 3,000 nits.

Apple develops a higher-efficiency LTPO backplane by adopting IGZO in the driving TFT

Apple was the first company to develop LTPO backplanes and it adopted this innovative and energy-efficient backplane technology back in 2018 in the Watch Series 4. LTPO combines Oxide-TFT and LTPS, by using the IGZO in some of the switching TFTs and LTPS in the remaining switching TFTs and all the driving TFTs. LTPO can reduce the power consumption by 5-15%, and enables variable refresh rate.

According to reports from Korea, Apple developed its 2nd-Gen LTPO backplane technology, that uses the IGZO in all the driving TFTs, and uses LTPS only in the remaining switching TFTs. This leads to higher efficiency compared to the first-generation LTPO backplane.

Apple cancels its microLED wearable display project

Apple entered into the microLED display industry in 2014, following the company's LuxVue acquisition. Since then the company has been very active with microLED development, with a first goal of replacing its wearable OLED displays with its own microLED displays.

Apple started developing microLED displays for wearable devices years ago, first aiming to launch the first product in 2023. The project was delayed several times, as the cost of production for microLED displays was too high for Apple, to the point where it was suggested Apple's goal is to launch the first microLED watch in 2027. One of Apple's key microLED partners, ams-Osram is is building a $850 Million 8-inch microLED epiwafer factory in Malaysia, and yesterday ams-Osram announced that its "cornerstone project" (it did not name Apple specifically) got unexpectedly cancelled.

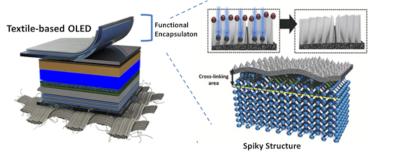

Researchers develop a new multi-functional encapsulation that can be used to produce fiber-based wearable OLEDs

Researchers from Korea's Gachon University, Seoul University and Chungbuk University developed a multi-functional encapsulation technology that can be used to develop fiber-based wearable OLED devices, deposited on textiles.

The new OLED device is produced on a light extraction substrate, that is super-hydrophobic - developed by coating a water-repellent layer on a rough surface obtained through ion beam treatment, ensuring excellent uniformity and easy power control. The new encapsulation offers high performance (10-6 g/m-2/day) and also achieves a UV transmission rate of less than 3%.

Samsung announces new foldable phones, tablets and smartwatches, all based on AMOLED displays

Samsung announced several new devices today, all utilizing AMOLED displays. We'll start with the two new foldable phones, the Galaxy Z Fold5 and Z Flip5. The Fold5 offers a foldable 7.6" 120Hz 1812x2176 foldable AMOLED display, and a 6.2" 120Hz 904x2316 cover AMOLED. The phone has a Snapdragon 8 Gen 2 chipset, 12 GB of RAM, up to 1TB of storage and a triple camera setup.

Samsung's Galaxy Z Flip5 smartphone offers a foldable 6.7" 120Hz 1080x2640 foldable AMOLED display, and a small 3.4" 720x748 cover Super AMOLED display. The phone has a Snapdragon 8 Gen 2 chipset, 8 GB of RAM, up to 512GB of storage and a dual camera setup.

AUO may close down its AFPD OLED fab in Singapore as it focuses on microLED for next-gen wearable and automotive displays

AU Optronics has a 4.5-Gen AMOLED production line in Singapore, active since around 2013. The AFPD line is a small-scale operation, and AUO never managed to expand its capacity and compete with large AMOLED producers.

According to a report from Japan, AUO is now considering closing down the AFPD line, and converting it to microLED R&D production line. It could move it back to Taiwan, or retain Singapore as a hub for AUO in Southeast Asia. The company will make a final decision, it seems, in early 2024.

A new version of our OLED and MicroLED Microdisplay Market report released

Today we published a new edition of our OLED and MicroLED Microdisplays Market Report, with all the latest information. The new edition offers more that a dozen new updates, new companies, new brochures and catalogs, and more. Global multinational companies are working hard to develop and deploy next-generation AR and VR devices, and these devices will all be based on OLED and microLED microdisplay engines.

Reading this report, you'll learn all about:

- The advantages of OLED and MicroLED microdisplays

- The microdisplays that are available on the market today

- Information on all companies involved in this market

- Future technologies and roadmaps

The report package also provides:

- A list of all OLED microdisplays on the market

- A list of all OLED and MicroLED microdisplays makers

- Microdisplays spreadsheet

- Over 25 datasheets, presentations

- Free updates for a year

This microdisplays market report provides a great introduction to OLED and MicroLED microdisplays, and covers everything you need to know about the current status of the market and industry. This is a great guide if you're considering to adopt OLED microdisplays in your product, if you're looking to learn more about next-generation micro-LEDs and if you want to understand this industry better.

Pagination

- Page 1

- Next page