We are happy to announce a new edition to the The OLED Toolbox, the OLED-industry's leading information product that provides an unprecedented depth of OLED content, data, analysis and insights, written and compiled by the industry's leading portal, OLED-Info.com. The new edition includes all the latest updates, devices, companies and displays up until April 2024.

The OLED Toolbox presents an unparalleled array of resources, including guides, projections, analyses, and profound insights into the world of OLED displays and lighting. Never before has it been so easy to gain access to a complete OLED industry resource!

What you'll find inside

- OLED Guide: an expert guide to OLED technologies, the OLED market and the OLED industry, covering everything you need to know about OLEDs

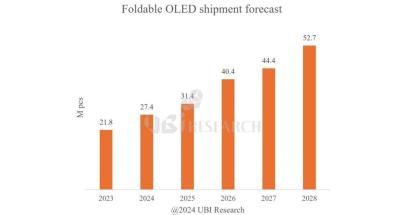

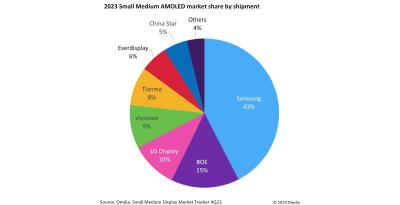

- OLED Insights: OLED analysis and insights, covering all the latest and future trends and developments in the OLED industry

- OLED Spreadsheets: excel files with detailed information on the OLED market and industry (including OLED devices, fabs, microdisplays, automotive solutions and more)

- OLED Leaders: In-depth articles by leading OLED professionals to discuss industry and market topics

- OLED Library: Over 160 content items by industry players - brochures, catalogs, roadmaps, presentations and more.