Recent OLED Industry News - February 2024

Here are some recent and popular OLED stories featured at OLED-Info, in case you missed it:

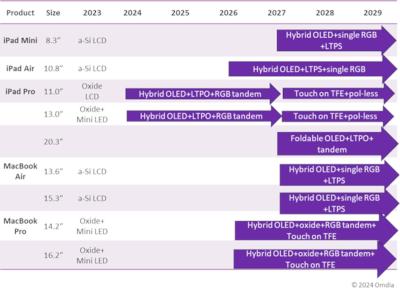

- Omdia updates its Apple laptop and tablet OLED adoption forecast

- Visionox produced its first ViP AMOLED display

- OLED-Info launches the revolutionary OLED Toolbox information product

- The MicroLED Association publishes its first microLED industry roadmap document

- TCL CSoT reiterates plans to start producing inkjet printing OLEDs in 2024

- LG Display said to be progressing with its 8.6-Gen IT AMOLED line plans

- Single-layer TADF OLEDs outperform the best multi-layer device

- BOE to build a 8.5-Gen IT AMOLED line in Chengdu

- Sidtek's 12-inch OLED microdisplay fab is on track for 2024 production

- Japan Display delays and scales back its plan to mass produce eLEAP AMOLED displays

- LG Display reveals its automotive display strategy and its latest OLED customers

- Yeolight starts installing production equipment at its $300 million OLED lighting fab

- UDC says it will have a commercial blue PHOLED emitter by 2024

Want to stay updated with the latest OLED news? sign-up for our free OLED industry weekly newsletter! Want to quickly become an OLED market and industry expert? Check out the OLED Toolbox now.