Foldable OLED displays can be bent by the user. These innovative displays enable new form factors, such as - such as phones that open into tablets, smart bands that open into smartphones and laptops with large displays. In 2019 the first foldable smartphones were launched, and after a rocky start, device markers are now introducing new devices to market as analysts expect increased adoption in the future.

Foldable smartphones

In 2019 Samsung finally introduced the first device, the Galaxy Fold - which had a problematic launch. Since then Samsung followed up with several new foldable phones, for example the Galaxy Z Fold 2 which sports an internal foldable display at 7.6" 1768x2208 HDR10+ 120Hz Dynamic AMOLED and also a larger 6.23" 816x2260 Super AMOLED cover display. Samsung also launched the clamshell-style Galaxy Z Flip.

Several companies offer foldable phones besides Samsung, including Motorola, Huawei and others. Huawei for example launched the Mate X2 in 2021, which features an inside-folding AMOLED display, a 8-inch 90Hz 2480 x 2200 one. There is also an external 6.45-inch 1160 x 2700 90Hz (240Hz touch sampling rate) AMOLED display.

Foldable OLED laptops

Foldable OLED laptops is another promising market segment. In 2021 Lenovo started shipping the $2,499 foldable ThinkPad X1 Fold laptop, with its 13.3" 2048x1536 foldable OLED display (produced by LG Display). Hopefully more companies will follow suit and we'll see more such devices on the market soon.

The foldable OLED industry & market

If you want to learn more about the foldable OLED technology, industry and market, check out our Flexible OLED Market Report. This comprehensive report explains:

- Why flexible displays and lighting panels are so exciting

- What kind of flexible displays are currently on the market

- What the future holds for flexible OLEDs

- Foldable OLED plans and forecasts

- How to acquire flexible OLEDs for your products

The report package also provides a complete list of flexible OLED developers and makers and their current (and future) products, and a lot more. Read more here!

The latest foldable OLED news:

Samsung announces new foldable phones, tablets and smartwatches, all based on AMOLED displays

Samsung announced several new devices today, all utilizing AMOLED displays. We'll start with the two new foldable phones, the Galaxy Z Fold5 and Z Flip5. The Fold5 offers a foldable 7.6" 120Hz 1812x2176 foldable AMOLED display, and a 6.2" 120Hz 904x2316 cover AMOLED. The phone has a Snapdragon 8 Gen 2 chipset, 12 GB of RAM, up to 1TB of storage and a triple camera setup.

Samsung's Galaxy Z Flip5 smartphone offers a foldable 6.7" 120Hz 1080x2640 foldable AMOLED display, and a small 3.4" 720x748 cover Super AMOLED display. The phone has a Snapdragon 8 Gen 2 chipset, 8 GB of RAM, up to 512GB of storage and a dual camera setup.

The Honor Magic V2 smartphone is highly popular in China, according to JD.com

Honor started selling it Magic V2 foldable smartphone 10 days ago, and according to online retailer JD.com, the phone was the 2nd most popular premium smartphones during the week (Apples iPhone 14 Pro is the most popular phone).

The Magic V2 model sold at JD.com costs 9,999 Yuan (around $1,400 USD). It seems as this is the first foldable that reaches high popularity in China, said to be mostly because of its thin profile and low weight (compared to other foldables). The phone is also sold at other Chinese outlets and can be ordered internationally through Aliexpress.

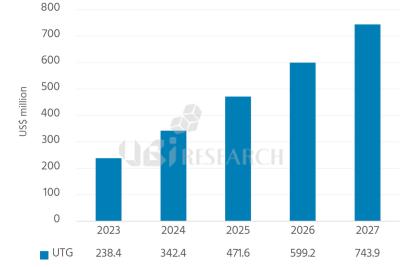

UBI: the foldable OLED market will grow to 61 million units by 2027

UBI Research estimates that the foldable OLED market will reach 22 million units in 2023, and will grow to 61 million units by 2027, a CAGR of 29%.

UBI also published a forecast on cover material market for foldable OLEDs - this market will also expand, and will grow to $840 million n 2027. UBI says that the market share of ultra-thin glass will grow, as Samsung will only produce foldable OLEDs with UTG in the future, and other makers including BOE, CSoT and Visionox are developing UTG panels.

Visionox shows its latest OLED prototypes and technologies at Display Week 2023

China-based Visionox demonstrated many OLED displays and new technologies at Display Week 2023.

So first up, we have some rollable and foldable OLEDs. You can see some impressive looking such flexible OLEDs in the video above, and Visionox featured many such displays at their booth.

TCL CSoT shows new foldable and rollable inkjet-printed OLED prototypes

TCL CSoT had several interesting new OLED demonstrations at SID DisplayWeek 2023, all of which were produced by inkjet printing, which shows the company's commitment to the new production process.

First up is the company latest inkjet-printed panel, this time CSoT showed a 8K (7680 × 4320) 65" TV panel that is foldable (with a bending radius of 25 mm). The panel offers a peak brightness of 800 nits, a response time of under 1 ms and a refresh rate of 120Hz.

AUO shows foldable, transparent and automotive microLED displays at Display Week 2023

Taiwan-based AU Optronics (AUO) demonstrated several microLED display prototypes at Display Week 2023, showing the company's focus on microLED display technology as its next-gen platform.

Sample displays include a 13.5" Full-HD 5,000-nits 55% transparent display, a 17.3" transparent panel that includes an embedded LC layer so it turn from 55% transparency to an almost completely opaque display, a 14.5" 2560x1440 foldable laptop display that is based on blue microLEDs with QD color conversion, and more.

Samsung Display shows its latest flexible OLEDs at Display Week 2023 and unveils the OLED Sensor Display

Samsung Display demonstrated many OLED technologies at Display Week 2023, which we'll detail below. It seems that the main new technology was the Sensor OLED Display, which is an OLED with an embedded sensor that can perform fingerprint sensing in addition to blood pressure, heart rate sensing and stress level sensing (all from reading the finger), which the company says is the first such display in the world.

The Sensor OLED Display embeds light-sensing organic photodiodes (OPDs) inside the display itself, which allows it to perform the sensing functions all over the display. Samsung explains that as OLED light is reflected differently depending on the contraction and relaxation of the blood vessels inside the finger, the OPD senses the light when it returns to the panel, and converts it into health information.

SID DisplayWeek 2023 - first impressions

Display Week 2023, the industry's premier event, is now over, and it was a great week. We had dozens of meetings and saw many next-generation display technologies. As we go over all materials, we will upload new stories to detail the displays on show.

In the meantime, here are our key takeaways from this show:

China's largest OLED substrate glass production line to reach mass production in August 2023

China's largest OLED substrate (carrier) glass production fab has initiated production, with full production is expected by August this year.

This is the first phase of the production hub planned at the Weifang Optoelectronics Display Materials Industrial Park, in Shandong province. Total investment in this line was 1.4 billion yuan (around $200 million USD), and the construction of the 2nd phase in this project has now started as well. The total investment in the four planned production lines will reach around $720 million USD.

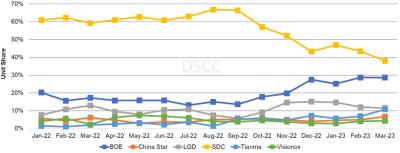

DSCC: BOE's market share in flexible smartphone OLED displays rose to 27%

DSCC says that BOE's market share in the flexible (and foldable) smartphone OLED market has risen to 27% in Q1 2023. BOE flexible and foldable OLED panel sales grew 81% in Q1 2023 compared to last year, as the company enjoys growing sales to Apple, Huawei, Oppo, Realme, Vivo and ZTE. BOE is mostly taking market share from Samsung and LG, while Tianma's market share is also on the rise.

DSCC estimates that flagship smartphone shipments grew 17% in the first quarter, with flexible OLED smartphone shipments growing 18% and foldable ones growing 4%.

Pagination

- Previous page

- Page 2

- Next page